- GoldenGround

- Posts

- July data abnormality in real estate demand

July data abnormality in real estate demand

What Buyers and Sellers Need to Know Now

TL;DR

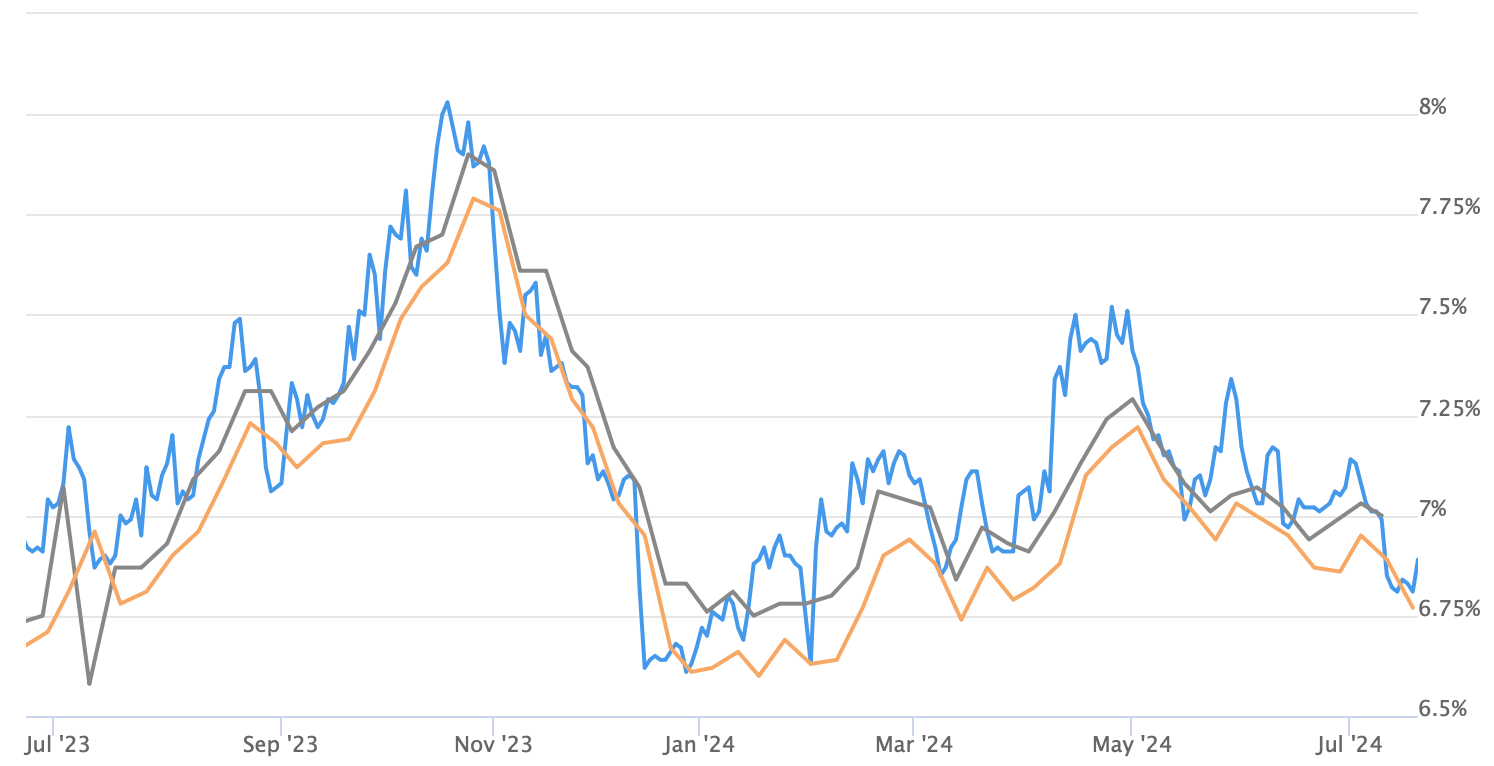

Mortgage rates have dropped to a 5-month low,

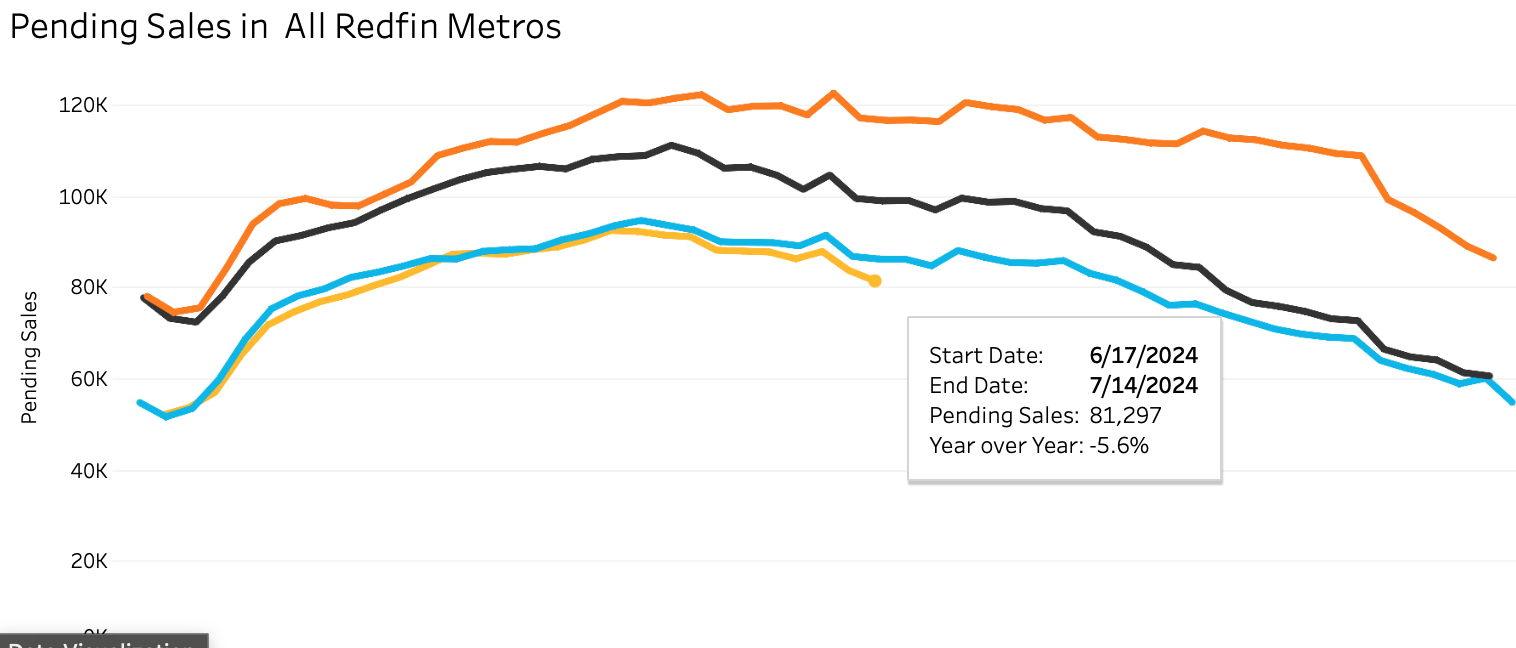

yet pending home sales have seen their biggest decline in eight months.

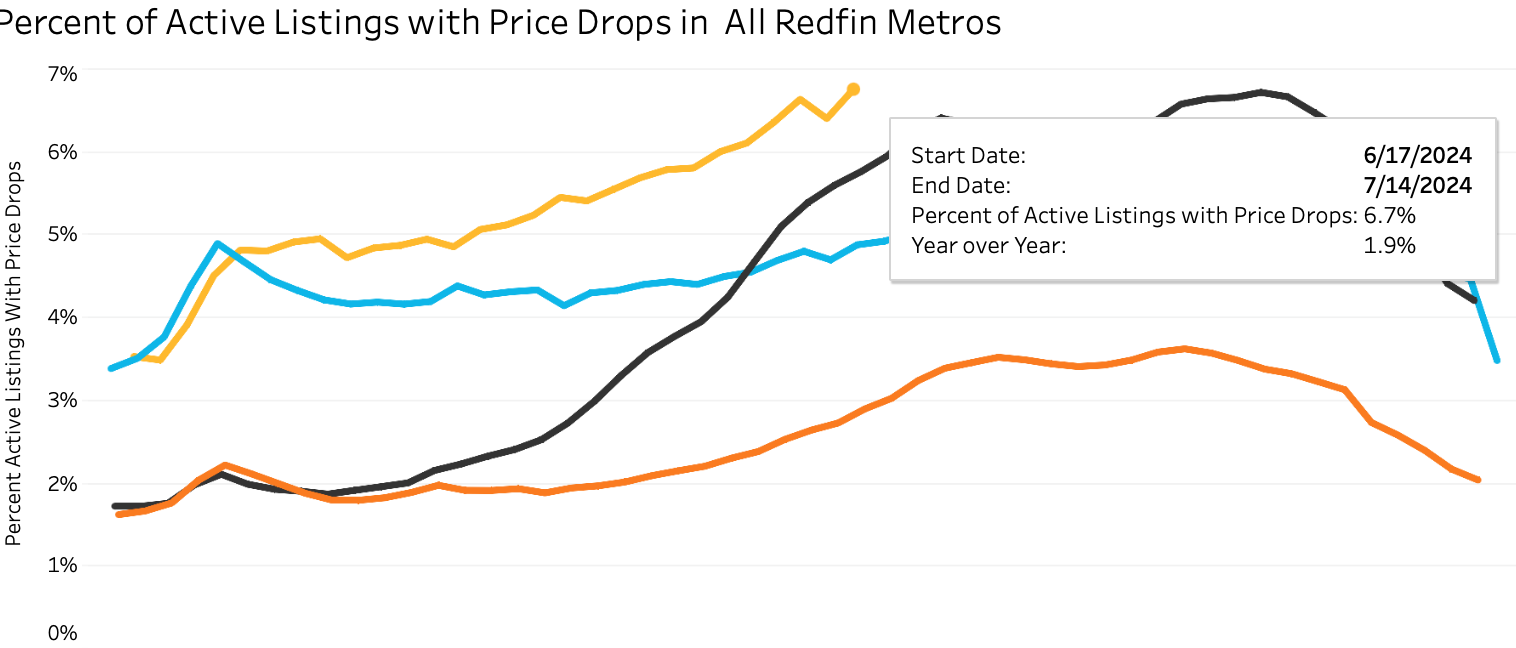

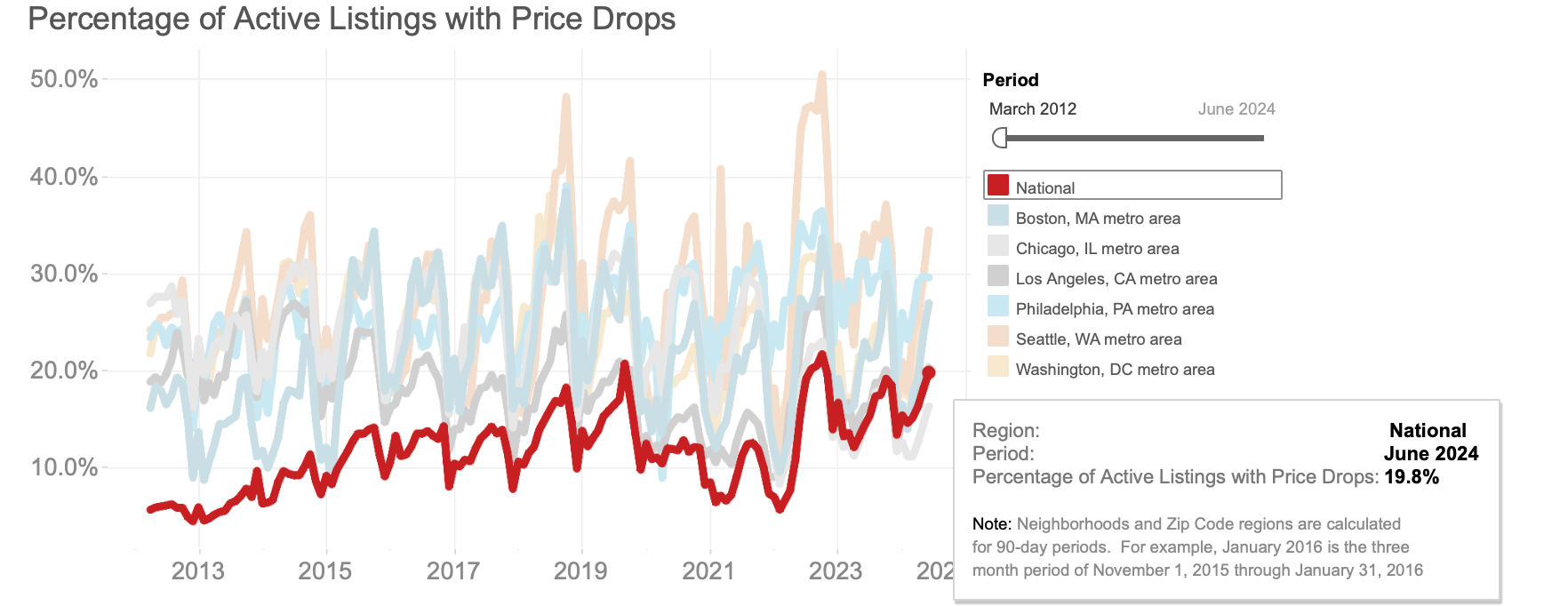

More homes are seeing price reductions, and active listings have dipped but remain high overall, indicating a possible shift toward a buyer’s market.

Mortgage rates dipped to a 5 month low in July.

Lower rates make borrowing cheaper, potentially increasing home affordability.

Pending home sales decline —largest drop in 8 months (-5.6%)

Pending home sales, the number of homes under contract but not yet closed, have decreased. This 5.6% drop is the largest in eight months, signaling a slowdown in the market.

The percentage of price reductions has reached a new high — where prices usually peak around winter time.

More homes are seeing price cuts, suggesting sellers are lowering prices due to lower demand or initial overpricing. Typically, prices peak in winter, making this trend unusual and possibly indicating a market shift.

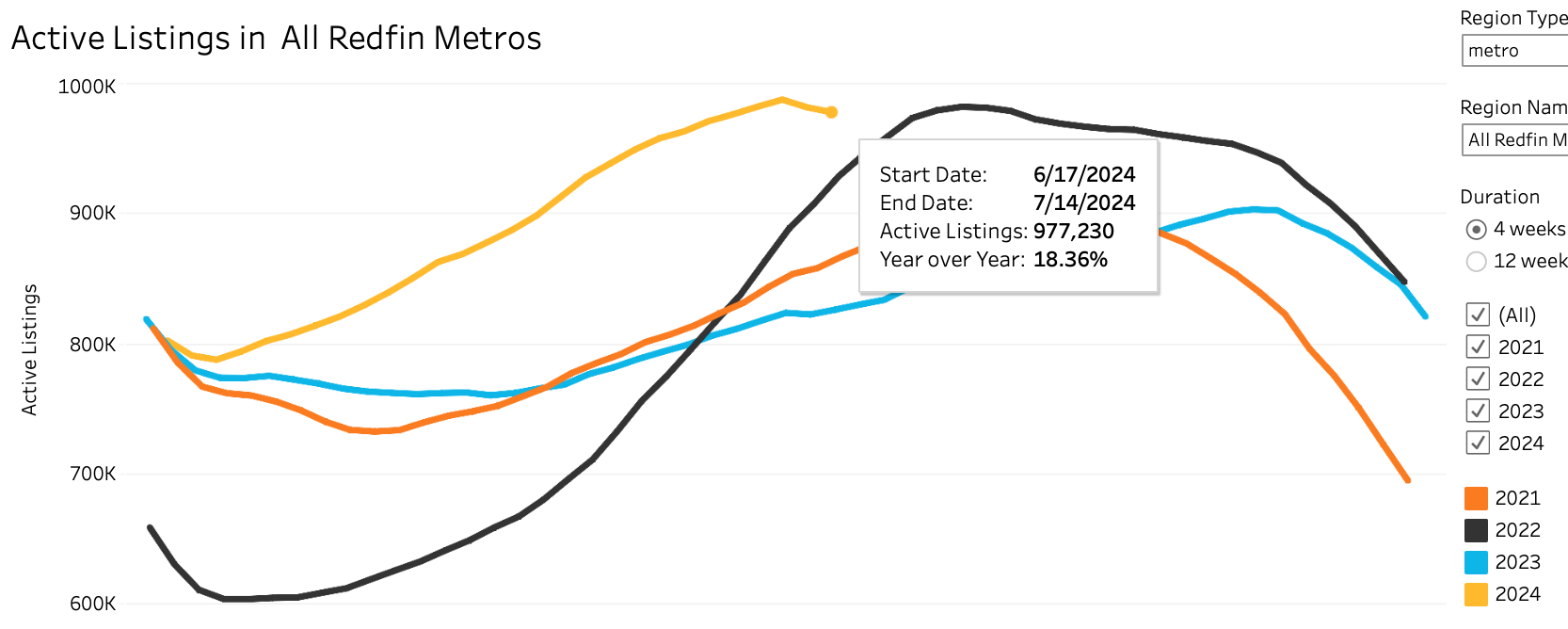

The number of active listing dipped, but is still at the highest level.

The number of homes listed for sale has decreased recently, but overall inventory remains high. This means fewer new listings, but a substantial number of homes are still available.

The real estate market is showing signs of cooling down. Despite lower mortgage rates, which usually stimulate buying activity, pending home sales are decreasing significantly.

More sellers are reducing their asking prices, suggesting that demand might not be keeping up with supply.

Although there are fewer new listings, the overall inventory of homes remains high, indicating a possible shift toward a buyer’s market.

Subscribe to Golden Ground for Real Estate reports, strategies and tips

Connect with me:

Twitter/X: https://x.com/VladShostak100