- GoldenGround

- Posts

- Affordable Investment Hotspots of 2024 Exposed

Affordable Investment Hotspots of 2024 Exposed

There are opportunities in other areas of the U.S — according to the NYPost, Redfin data, and Realtor.com investment reports.

There are opportunities in other areas of the U.S — according to the NYPost, Redfin data, and Realtor.com investment reports.

Inflation and the surge in home prices might have you thinking it’s a bad time to be a real estate investor.

But not every state and region is unaffordable or a bad investment — investor activity clearly shows this (more below).

How is that possible? Many metro areas and suburbs have skyrocketed, but not all.

Everyone didn’t all just move to every possible great metro and suburb in the U.S, because of this, there are opportunities out there being presented right now,

you just have to spend more time looking

(thank the Lord you have me to look for you 🤝).

If you have been comfortable (I am guilty of this) getting to know the area that you live in now, and it’s a bad or unaffordable investment opportunity,

you have to get uncomfortable and get to know the areas that are becoming good investments right now.

Out of state investment carries risk, but with the right team and knowledge it could be done successfully.

Think about what story is unfolding in residential right now, H2 2024?

📖 In the current metro areas and suburbs, new and existing home owners and tenants are finding that these areas are overcrowded and overpriced

— even if prices stabilize and the rate of people moving in dwindles.

These people are looking at other areas, similar to Austin, Fort Worth, NW Arkansas, Orlando, Raleigh-Durham, Denver… etc.

Since those areas are now f***ed, people have started moving into other areas we will discuss here shortly… and this creates investment opportunities. These opportunities are also more affordable 💡 — check this out:

“From January to March 2024, small investors

(defined as having purchased 10 or fewer homes since 2001)

made up 62.6% of investor purchases.

That’s the highest small-investor share since our data commenced in 2001.”

Even though the average homebuyer might be feeling sidelined under the weight of high interest rates,

real estate investors are stepping in to snatch up a record share of homes:

Investors made up 14.8% of home purchases in the first quarter of 2024

Okay, so now that I got you convinced and excited,

what are these areas?

How are people investing successfully?

Risks to watch out for?

Let me attempt to answer some of these question for you

— leave a comment if you find this valuable and please

share any thoughts on what you’re seeing/struggling with in the current residential real estate market, would love to bounce back ideas and share more.

Best residential real estate markets to invest in 2024 (according to data)

High interest rates and inflation force investors to look for affordability.

Because of this, the Midwest and the South

have had the the highest share of investors out of the 150 largest U.S. metros.

Homes in the Midwest metros are:

relatively lower-priced (on average),

rents in those areas are climbing.

This creates a win-win scenario for investors.

“More buyers may be choosing to invest in affordable markets that need more rental inventory in order to secure a steady stream of rental income,” - Jones.

The hottest markets

#1 Missouri

3/5 markets seeing the highest share of investors during Q1 of 2024 were in Missouri (MO) — the “Show Me State”.

Springfield, MO

Investors purchased around 1 in 5 homes (20.5%), which was the highest share among the 150 largest metros.

Living in Springfield:

One great thing about Springfield is it is easy living. Traffic is very tolerable, mostly everything is easy to access and it’s cheap. The cost of living can’t be emphasized enough

Springfield is great if you love the outdoors:

An hour south, you’ve got Buffalo National River in Arkansas, and

Roaring River State Park (SP), Bennett Springs SP, and Tonka SP are perfect for hiking, fishing, and canoeing, 1 hour 30 minutes.

Route 66 goes right through the city for a road trip towards St. Louis. Kansas City, Tulsa, and Little Rock — all about the same distance away too.

If you’re a baseball fan, they have the Springfield Cardinals (AA team for the St. Louis Cardinals) — the games are fun and cheap.

Kansas City, MO

20.1% of purchases go to investors.

Information on the area:

Kansas City is a modern metro area — a lot more things to do as a young adult (restaurants, music, great night life, bars, etc).

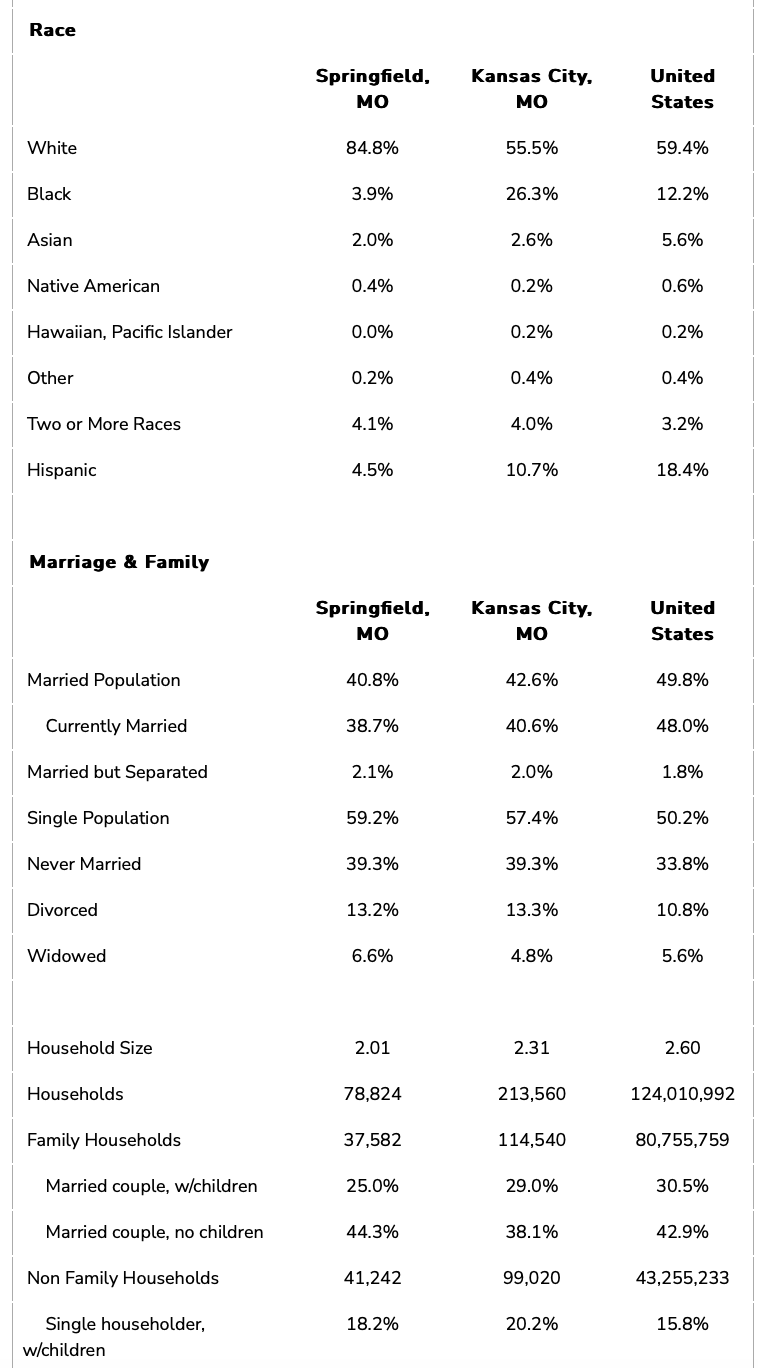

Some stats comparing the two

St. Louis, MO

18.9% of purchases go to investors.

More relaxed, great suburbs, but you need to know the neighborhood as some areas have higher crime rates (revitalization efforts are ongoing).

Birmingham, AL

18.7% of purchases go to investors.

Pros and Cons of living in Birmingham:

Pros:

Cost of Living: The cost of living is significantly lower than in California. Housing and everyday expenses are more affordable, but arguable if you’re coming from say Tennessee.

Downtown Variety: There are enough activities, restaurants, and breweries to keep you entertained.

Commute Times: Generally, commute times are short and manageable.

Mild Weather: Mild winters with less extreme cold.

Airport Convenience: Birmingham’s airport is small but easy to navigate with short lines and close parking.

Cons:

Limited Major Events: For major events, you often need to travel to Atlanta or Nashville.

Proximity to Major Cities: Birmingham is within a half-day drive to Atlanta, Nashville, Chattanooga, and the beach.

Smaller Airport: Limited direct flights; usually requires layovers.

Weather: Summers are very hot and humid, which can be uncomfortable.

Road Conditions: Roads are often in poor condition with many potholes.

Utilities and Taxes: High water bills and relatively high state income tax compared to some states.

School Costs: Good schools are typically in more expensive neighborhoods.

Memphis, TN

18.2% of purchases go to investors.

Pros and Cons of living in Memphis:

Pros:

Cost of Living: Memphis is quite affordable compared to many other cities, including California. Housing costs and everyday expenses are lower, making your money go further.

Cultural Scene: The city is rich in history, music, and culture. It’s the home of blues and has a vibrant arts scene.

Food: Known for its barbecue, Memphis offers a diverse food scene that will satisfy any foodie.

Small City Feel: Despite being a big city, Memphis feels smaller, offering suburban-style living with houses and yards.

Community: Memphians are generally friendly, and the city is welcoming to transplants.

Airport Convenience: Memphis International Airport is easy to navigate and not overly crowded.

Natural Resources: The city has excellent water quality thanks to the Memphis Sand Aquifer.

Cons:

Crime: Memphis has a high crime rate, and safety can be a concern. Certain neighborhoods are safer than others, so it’s crucial to choose your area wisely.

Schools: Public schools in Memphis can be hit or miss. Some schools are excellent, but many families opt for private schooling due to the inconsistent quality of public education.

Weather: Summers in Memphis are hot and humid, which can be uncomfortable if you’re not used to it.

Infrastructure: Some areas suffer from power outages and issues with aging infrastructure.

Driving and Traffic: The driving habits in Memphis can be unpredictable, and traffic can be chaotic at times.

Limited Outdoor Activities: While there are some options, the hot and humid weather can limit outdoor activities for part of the year.

Economic Disparities: There are noticeable economic disparities across different areas of the city, impacting the overall living experience.

Areas with signifiant price growth below national median

The following areas have seen significant price growth since 2019

but still fall below the national median.

This means homes are still affordable, there is potential for continued appreciation, and potential for higher rental yields.

The top five are:

Savannah, GA (up 8.3%),

Youngstown-Warren-Boardman, OH-PA (up 7.9%),

Peoria, IL (up 7.2%),

Springfield, MA (up 6.4%),

and Montgomery, AL (up 6.3%).

This increases investor appeal because:

1 — There is potential for continued appreciation — areas experiencing significant price growth are likely to continue appreciating

2 — Affordability: Properties below the national median price are more affordable, making it easier for investors to enter the market.

Like what you read? so did I, subscribe to the newsletter for more RE reports, strategies and tips 👉 https://www.getgoldenground.com/