- GoldenGround

- Posts

- What You Must Know Before Buying Foreclosures in 2024

What You Must Know Before Buying Foreclosures in 2024

“I’m giving you a discount on this because there is some problem with it, good luck”

What You Must Know Before Buying Foreclosures in 2024

“I’m giving you a discount on this because there is some problem with it, good luck”

Last updated: July 2024. The following is not financial advice; always do your own research.

Strapped for cash and looking for a deal? Buying a foreclosed home might have crossed your mind.

Foreclosed homes are repossessed by lenders due to defaulted mortgages and often sell at bargain prices.

BUT… finding good foreclosure deals has become a lot tougher,

and there are 5 key risks to watch-out for — read on below.

A decade ago, foreclosures were THE WAY to get a bargain in real estate.

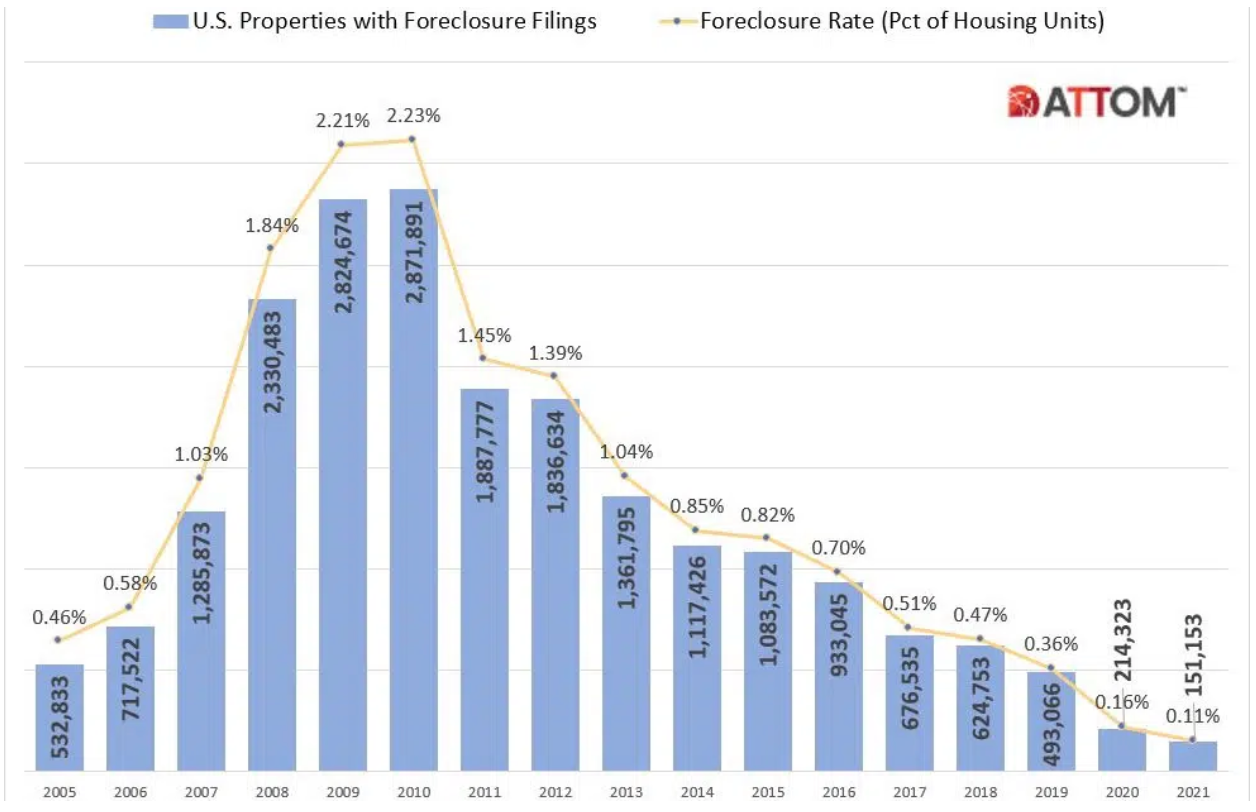

📉 During the peak of the 2008 financial crisis, in 2010, there were 2.8 million foreclosures.

👉 This year, there were less than 360 thousand.

What does this mean?

When the pool of foreclosed properties was larger, the chances of getting a good deal was higher.

This brings us to…

Want to learn HOW investors find foreclosures in 2024?

👉 How Real Estate Investors Locate The Best Foreclosures in Any Market

What to watch-out for when buying a foreclosure in 2024

When people think of foreclosures they immediately think that every foreclosure deal will make them money.

Sometimes this is true, sometimes it isn’t, and it’s less so when the pool of foreclosures is smaller.

In today’s market, if a property goes to foreclosure it most likely means there was an issue aside from the borrower not being able to pay up.

First-time buyers often think if a property went to foreclosure it means it is just a problem with the borrower. This is often not the case — there are additional issues to be mindful of.

A good way to think of it is:

“I’m giving you a discount on this because there is some problem with it, good luck”

Your job is to find and assess the problems.

There are risks with buying foreclosures you must know about. (Photo by Robin Jonathan Deutsch)

The problems of buying a foreclosure:

#1 Problems are not disclosed

The actual problems with foreclosures are not disclosed because they are not legally required to do so.

These problem could be any of:

Even if the property is not in a flood zone, it may still have poor drainage where the front yard turns into a muddy pool.

Damage behind walls, damaged wiring, or a moldy carpet.

Electrical wiring may not meet current codes or could be faulty, needing extensive rewiring.

Not meeting current building codes or safety standards, requiring renovations to bring them up to code.

Nearby nuisance like a bad neigbor or being near a train track that comes by 3 days a week at 7 am.

#2 Little to no room for negotiation or repairs

Although you get to do an inspection, foreclosed properties are typically sold “as-is”.

So while you can discover issues during the inspection, the seller (typically a bank or financial institution) is not required to make any repairs.

You might get a price reduction if you discovered something terrible during the inspection. However, if you’re new to real estate, you might not be able to assess the costs to fix external or internal issues and the costs of the materials to do so.

If possible working with a real estate agent who has plenty of experience with foreclosures can help you assess how much damage and repairs might add-on to the cost of this seemingly “good deal.”

#3 Fees and back taxes fall on the buyer

You will typically have to pay all the closing costs (title insurance, escrow fees, attorney fees, etc) and any back taxes.

Back taxes are any unpaid property taxes that have accumulated over time and must be paid before the property can be legally transferred to you.

#4 Financing

Financing on foreclosed homes can be more difficult because lenders typically shy away from offering loans on distressed properties.

When it comes to financing foreclosed homes, things get tricky. Traditional banks don’t like dealing with these distressed properties. Why? Because they’re often in rough shape and need major repairs.

If you find a foreclosure missing something crucial, like plumbing or a kitchen, forget about getting a regular loan. You’ve got two choices: pay cash or go to a hard money lender.

Here’s the deal with hard money lenders: they’re private entities or individuals, not banks, who will loan you the money short-term. But be prepared — they charge higher interest rates and want a big chunk of cash upfront. Yes, it’s more expensive, but it gets you in the game fast when traditional financing won’t cut it.

Workaround for financing renovations

There’s another smart play here: the renovation housing loan. This option lets you wrap the cost of any necessary repairs right into your home loan. It’s a powerful tool, especially if you’re eyeing a foreclosed property that needs a bit of TLC.

Here’s how it works: With a renovation loan, you can finance both the purchase price and the renovation costs in one swoop. But remember, you’ve got to have solid credit and a good debt-to-income ratio to qualify. Lenders want to see that you’re a low-risk borrower before they hand over the cash.

The beauty of this loan is that it simplifies your financing. Instead of juggling multiple loans, you’ve got everything tied up in one package. Plus, you’re often able to get a lower interest rate compared to hard money loans. This can save you a lot of money in the long run.

Think about it. You buy a foreclosed property at a discount, roll the renovation costs into your mortgage, and suddenly, you’re sitting on a fully renovated property with increased market value. It’s a smart move for those who qualify and can handle the process.

# 5 Longer process

When buying a foreclosure property, be ready for a lot of paperwork and possible delays. These purchases often involve more legal documents and formalities, making the process slower than regular home purchases. If you’re hoping to move in quickly, a foreclosure might not be the best choice because banks can take months to respond to offers.

Inspections are crucial when buying a foreclosure because you’re purchasing the property in its current condition, no fixes included. It’s essential to know exactly what you’re getting into, so make sure to inspect the property thoroughly before making a commitment. This will help you avoid any hidden problems that could end up costing you more money and trouble later on.

How Real Estate Investors Locate The Best Foreclosures in Any Market

Subscribe to my real estate newsletter to learn working strategies and tips in todays market:

Subscribe to stay updated on real estate trends and gain knowledge from the experts on real estate investing