- GoldenGround

- Posts

- The Proven Steps to Evaluate Rental Properties and Find Your Perfect Investment

The Proven Steps to Evaluate Rental Properties and Find Your Perfect Investment

Your Ultimate Guide to Determining a Good Rental Property

Identifying undervalued properties and areas with high rental demand is the bread and butter of successful rental property investing.

So, in this blog post I will answer,

How to decide if a rental property is a good investment?

Before diving in, let’s acknowledge the fact that buying a rental property can be both exciting and terrifying, especially if it is your first time doing it.

There are many investment options to consider, with the most popular being:

Residential Properties — Purchasing properties such as houses, apartments, and townhouses which are typically rented out to tenants for residential purposes.

Commercial Real Estate — Purchasing office buildings, warehouses, and retail spaces and renting them out to businesses.

Industrial Real Estate — Purchasing factories, industrial sheds, and warehouses used for production, storage, and distribution of goods

Land Investment — Purchasing land for development, resale, or use in agricultural projects.

Vacation Rentals — Properties in high-demand tourist locations can be rented out on a short-term basis to vacationers.

Fix-and-Flip — Buying properties at a low price, renovating them, and selling them at a profit.

If that’s not enough, each type has its own set of challenges, risks, and considerations.

Although daunting, you can succeed in this field.

There are plenty of resources designed to guide you — such as those found on BiggerPockets, REtipster, and now on RealEstatePlaybook — helping you grow from a beginner to the confident investor you aspire to be.

Remember, every seasoned investor was once a beginner, and with the right knowledge and tools, you can make informed decisions that meet your financial goals.

So let’s begin,

Effective property evaluation requires us to know 2 things:

The local market,

and answer 2 questions when it comes down to evaluating the financials:

a — Is it worth it?

b — Is it fair?

First let’s cover what to look for when assessing your local market — I will use my hometown of Rogers, Arkansas as an example.

#1 Evaluating Your Local Market

Every property sale is influenced by your local market conditions.

We need to pay attention to:

Rental demand

Rental prices (comparables & market trends)

Current and future development projects

Let’s go over each one using my local area of Rogers, Arkansas as an example.

(You can use the same process to analyze your local area)

How to Check Rental Demand in Your Area

Let’s look at our local, regional, and state economic data to find out how easily we can find tenants and what kind of rent we can charge.

We want to know

What is the demand for rentals in my area?

Is this demand increasing/decreasing?

Key factors to watch are employment rates, job growth, major industries, and major employers.

This information can be found on local government or economic development websites.

For my area of Rogers, Arkansas, I Google searched:

“Arkansas Economic Development Commission population and jobs statistics 2024”

and found THIS 2024–2028 Comprehensive Economic Development Report:

We can see that people are moving into the area and the job market seems to be keeping up.

This let’s us know that there should be strong demand for rentals at good rental prices ahead.

You would want to find these reports for your specific region.

As an example, lets say you were looking at the real estate market in Texas.

Texas A&M University has a Real Estate Research Center that publishes extensive data on housing, commercial real estate, and market analysisspecifically for Texas. You can find this kind of data for every state.

Hint: Ask ChatGPT for the top 5 sources for your state and start there.

Most importantly, don’t forget about the power of networking to connect with local real estate agents. Websites like Meetup can be helpful in finding these groups.

They can offer insights about different neighborhoods and help find properties that match your criteria (Give them some quality referrals or other value in exchange and most will be more than happy to help you).

How to Find and Track Comparable Rental Prices

Now, let’s get an accurate picture of what comparable homes are actually renting out for in our area.

Let’s first do this the “manual way” first by looking at Zillow and Rentometer.

(You can also check out Realtor.com, Apartments.com, and local listings)

Searching on Zillow:

Searching on Zillow by setting the filters to be as close to our comparable property as possible gives us a sense of what homes or apartments are renting for in different parts of Rogers.

Choose 3 comps (comparable homes) that best match up to your property and location.

Later, we will make adjustments for the difference in bedrooms, bathrooms, age, and features.

Searching on Rentometer:

As you can see, Rentometer is a nifty tool specifically designed to help landlords and investors compare their rental property’s rent with other local rentals.

Quickest Way to Track Rental Prices, Property Prices, and Time on Market

As we saw, we can manually track both property prices and rents on sites like Zillow or Redfin. If we wanted, we could also setup alerts for specific areas and specific properties that fit our criteria.

However, if you want to easily & quickly visualize trends and comps (comparable homes),

you can use a software like RentCast — or ask our agency to create a bespoke integration for you & your team — so you can get useful detailed reports like these:

To easily track property prices and time on market for a specific region, we can use PropStream:

Much faster isn’t it?

Alright, let’s move on to the last piece of the puzzle for evaluating our local market.

Tracking Development Projects in Your Area

Staying informed about new development projects can provide valuable investment opportunities, as these projects influence residential real estatevalues.

Knowing when and where upcoming infrastructural or commercial developments are taking place allows us to anticipate shifts in demand and property values in the area.

How to track new infrastructural and commercial developments?

In NWA, local news publications like the Northwest Arkansas Democrat-Gazette, often provide valuable reports on new development projects and urban planning initiatives.

For instance, THIS one from November of 2022 about a Whole Foods that is currently being built right now in Rogers (in 2024), as I write this.

Of course, the best way to learn about new developments is by connecting with local real estate agents, builders, architects, and city planners, as they are the first to know.

Now that we covered how to evaluate our local market, let’s look at how to analyze the financial viability of a rental property.

#2 Financial Analysis for Rental Properties

There are many property deals happening all of the time, so we need to have a way to filter out bad deals, and only spend time analyzing potential good ones.

Here is what we will cover:

1 & 2 answer the question of “Is It Worth It?”

3 answers the question of “Is It Fair?”

The 1% & 50% rule — filter out deals that will never work

Back of Envelope Analysis (BOE) — quick financial viability screen

Comparative Market Analysis (CMA) — Is the price fair?

How to Use The 1% Rule (or 2% Rule)

This rule can be used to quickly assess the potential profitability of a rental property.

It states that: the monthly rent of a property should be at least 1% (or 2% in an ideal scenario) of the property’s purchase price.

Example:

Property Purchase Price: $200,000

Desired Monthly Rent (1% Rule): $2,000

Desired Monthly Rent (2% Rule): $4,000

In the real world:

Targeting a 2% ratio is difficult in most markets today, as property prices have risen by a lot. The 1% rule remains a basic guideline, with some investors settling for slightly less to accommodate the high purchase prices.

Considerations:

While the 1% rule is useful as a tool, it’s not flawless.

Many successful investments are made on properties that don’t meet this rule but excel in other criteria such as location desirability, potential forrapid appreciation, or unique value-add opportunities.

Consider using the 1% rule as a preliminary filter rather than a strict cutoff. If a property doesn’t meet the 1% rule but is close, it might be worth taking a deeper look to assess other factors like location, potential for rent increases, or lower-than-average operating costs.

How to Use The 50% Rule

This rule is helpful in estimating cashflow by assuming the operating costs of a property.

It states that: 50% of the rental income will be consumed by operating expenses (excluding mortgage payments).

Example:

Monthly Rent: $2,000

Estimated Operating Expenses (50% Rule): $1,000

Remaining for Mortgage and Profit: $1,000

If a mortgage payment on this property is $800, then the estimated monthly cash flow before taxes and other costs would be $200.

In the real world:

Even for properties that look good on the surface, the 50% rule acts a valuable heuristic because we typically underestimate long-term expenses.

For instance, the rule factors in the inevitable replacement costs of things like a roof (20–30 years), and other unexpected maintenance costs that typically arise — things that you might not immediately think about.

With that said, the actual proportion of income that goes towards expenses can vary based on several factors. For a well-managed property, expenses might consistently fall below the 50% threshold. Whereas for older properties, where landlords are responsible for paying utilities, they might see expenses that exceed 50%.

Considerations:

Depending on some of the below factors, investors might adjust the rule to 40% or 60% as a more accurate reflection of a property’s operational costs.

For example, a very hands-on landlord in a low-maintenance property might experience lower costs, while a hands-off landlord in an older building might have higher expenses.

Factors to consider:

Property Type and Age

Location Impact (properties in coastal areas might have higher insurance premiums due to the risk of flooding or hurricanes)

Management Strategy (self-managing a property can save on management fees — typically 8–10% of rental income at the expense of stress and time)

Economic Changes (economic factors such as inflation and changes in tax laws)

Back of Envelope Analysis (BOE)

A Back of Envelope Analysis is a quick test to see if a property investment is viable financially. It’s something you could jot down on a napkin or envelope — hence the name.

Since the BOE method makes assumptions about things like expenses and rental income,

if you get a good understanding of the properties and market conditions in your local area,

it becomes very valuable in quickly filtering out less promising options, allowing you to focus on those with potential.

When to Use it

In the early stages of evaluating a property, such as:

When first coming across a property that fits your criteria, whether that’s through Zillow, email, or from your network.

Tax lien and foreclosure auctions — In situations where you have limited access to property inspections beforehand, a BOE analysis can help decide on a maximum bid that reflects potential value minus estimated repair costs and liens.

When considering a large number of properties and needing to narrow down choices efficiently.

Example

You are evaluating a residential property listed for $300,000.

You estimate the monthly rental income to be $3,000.

Gross yield — Calculate the annual gross yield

Monthly Rent$3,000Annual Rent$3,000 x 12 = $36,000Gross Yield($36,000 / $300,000) x 100 = 12%

Estimated Operating Expenses (50% rule)

50% of Annual Rent = $18,000

Net Operating Income (NOI) (Subtract expenses from gross income)

NOI = $36,000 — $18,000 = $18,000

Cap Rate

Cap Rate = (NOI / Purchase Price) x 100 = ($18,000 / $300,000) x 100 = 6%

This gives you a quick look at potential profitability for a property purchased in cash.

What about a when a loan is involved?

I personally have a BOE excel spreadsheet that calculates the IRR, Average Yield and Cash Multiple like this:

Comparative Market Analysis (CMA) — Is It Fair?

Real estate agents & investors often use Comparative Market Analysis (CMA)to estimate the value of a property by comparing it to similar properties that have recently sold in the same area.

This analysis helps determine a competitive price for a property that is being listed for sale or evaluated for purchase.

When to Use it

A CMA is useful when:

Making an offer on a property — Useful for buyers to determine whether a property is priced fairly before making an offer.

Refinancing a property — Helps property owners to justify a property’s value to secure the best possible refinancing terms.

Appealing a property tax assessment — Can be used to argue that a property’s assessed value is out of line with the market, which could lead to lower property taxes.

How to Perform a Comparative Market Analysis (CMA) on a Rental Property

In Zillow I will search for 3 comps (comparable properties) in the same area as my comparable home.

I will apply a filter to look for properties that are:

As close to the same condition and style as possible

Sold within the last 3–6 months.

Later we will make adjustments for the difference in age, features, date of sale.

🚨 Do note that: There may be other conditions that we may not be able to determine just from looking at the listing on Zillow such as:

Quick Close — A buyer who can close quickly might negotiate a lower price in exchange for the speed and certainty they offer to the seller.

Family Sale Discount — If a property is sold to a relative, it might be sold for less than its usual price as a kind gesture.

Closing Cost ‘Concessions’- In some deals, the seller might pay for the closing costs to help make the sale happen. This lowers the price the home was sold at.

Getting to know the area personally by networking with local real estate agents and listing agents will enable you to know these details.

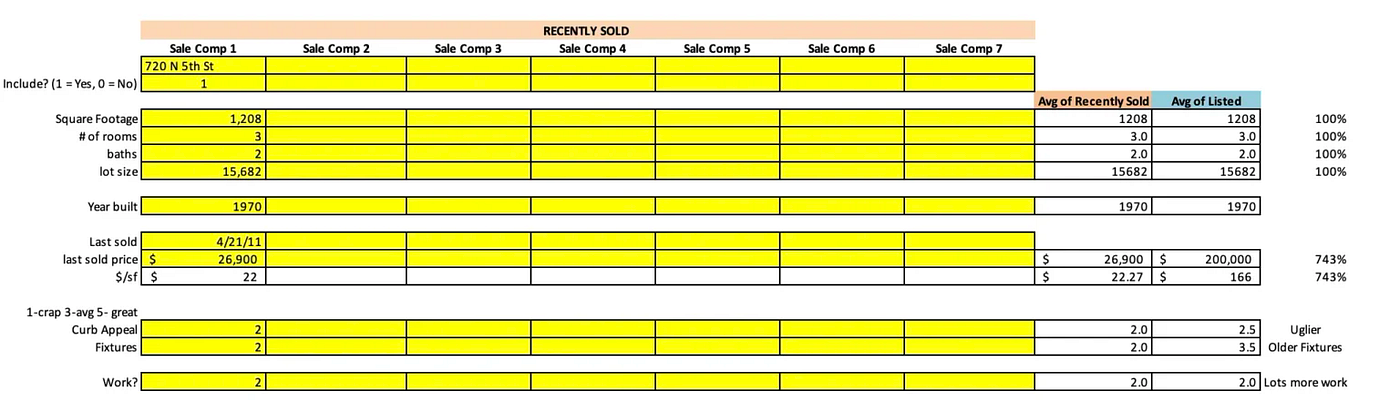

Again, just like for a BOE analysis, for a CMA, I also use an excel spreadsheet that tells me the averages of the comps I chose and allows me to assess the curb appeal, fixtures and amount of work needed:

I recommend starting with excel and then trying software like PropStreamwhich can quickly provide comps from MLS and public records.

It is especially useful to toggle between MLS and public record data when evaluating properties in non-disclosure states(states where property sales are not required to be publicly disclosed).

Evaluating comps using Propstream

So far we learned how to analyze the following in our local market:

Rental demand

Rental prices (comparables & market trends)

Current and future development projects

We also learned how to evaluate the financials of a potential rental using:

The 1% & 50% rule — filter out deals that will never work

Back of Envelope Analysis (BOE) — quick financial viability screen

Comparative Market Analysis (CMA) — Is the price fair?

In the next few posts, we will be diving deeper — I will be sharing more useful tools, examples, and insights for your real estate property investing success.