- GoldenGround

- Posts

- Why Aren’t Rents Growing

Why Aren’t Rents Growing

Elevated Completions, Rent Stagnation, Rising Cost

It’s no secret that multifamily real estate is experiencing a tough year. The convergence of several factors is creating a perfect storm that owners and operators must navigate carefully.

Lower rental growth and increased operating expenses are squeezing profit margins, making it harder to achieve the returns many investors hope for. This, in turn, affects the attractiveness of these properties to lenders for refinancing.

All data sourced from Moody’s July 22, 2024 report HERE

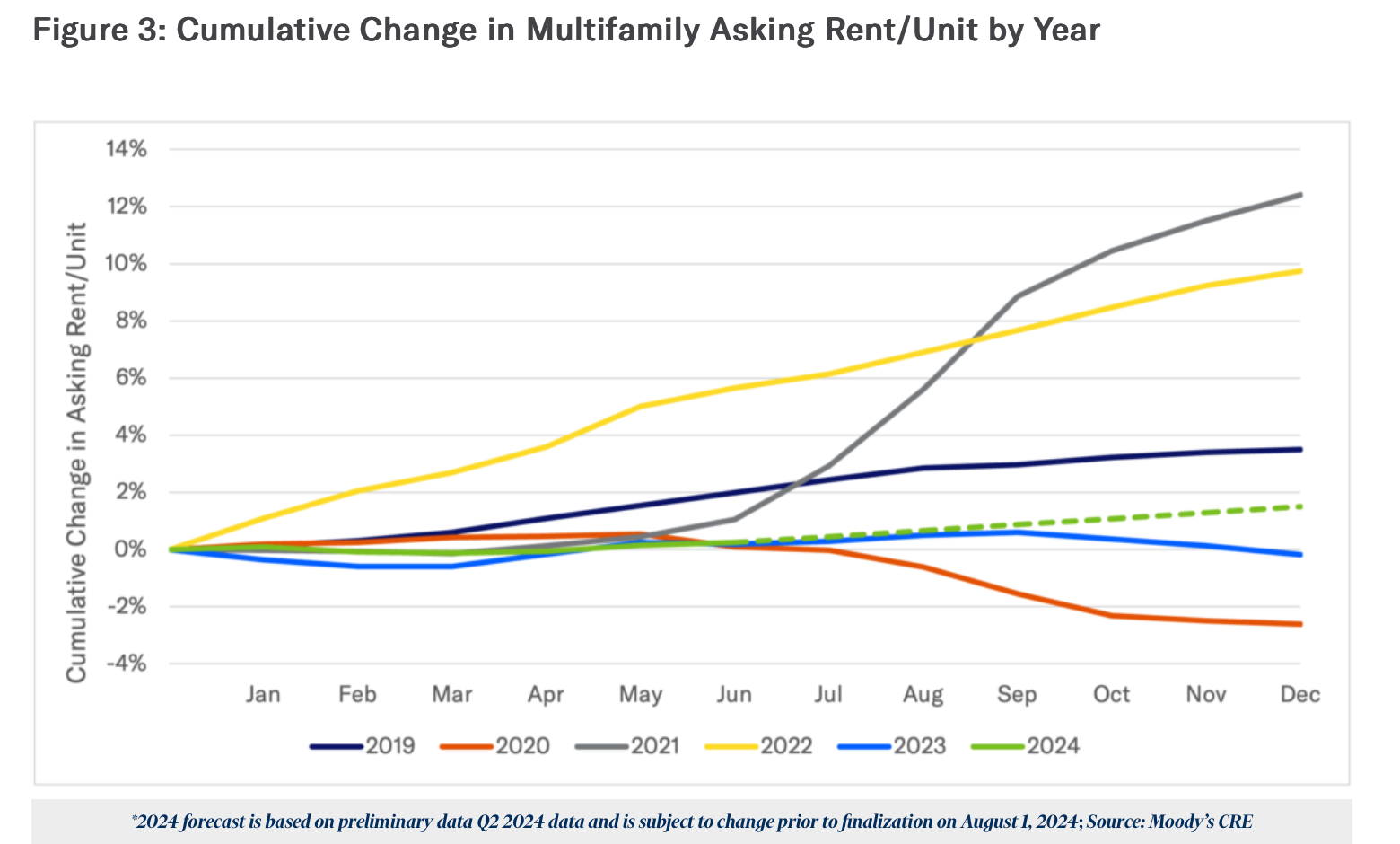

According to Moody’s, the rent growth projection for the U.S. as of the second quarter of 2024 is in the low-to-mid-1% range.

That’s a significant slowdown, and it’s been consistent for three quarters now. The gap between asking and effective rents remains above $90, reflecting the highest concession levels in Moody’s tracking history.

Whether it’s lowering average monthly rent or offering rent-free periods during negotiations, landlords are feeling the pressure.

1. Why Aren’t Rents Growing Like I Expected?

Welcome to 2024, where the rent growth fairy seems to have taken a nap. Moody’s pegged U.S. rent growth in the low-to-mid-1% range for Q2 2024. Why so sluggish? It’s a classic case of supply and demand imbalance.

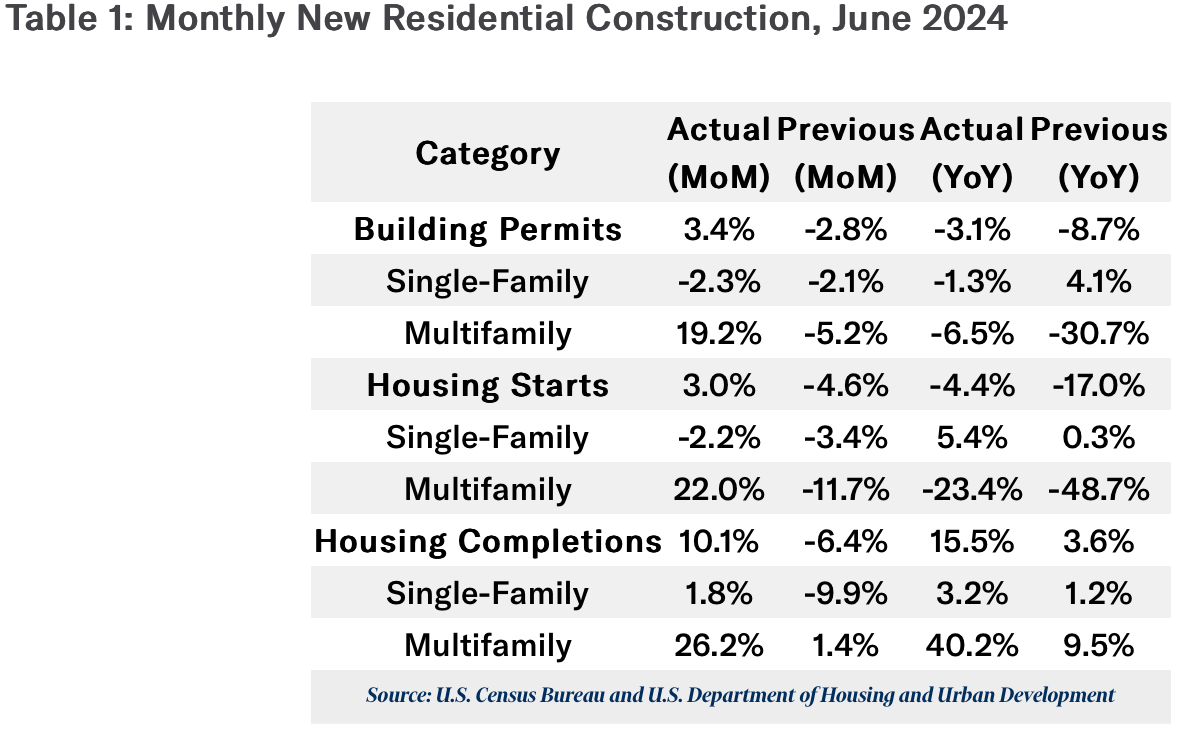

We’ve got a boom in housing units, especially multifamily ones.

In June 2024, private-owned housing completions hit a seasonally adjusted annual rate of 1.71 million units.

Of those, 656,000 were multifamily. That’s a 40.2% year-over-year increase — the highest since 1974! More units mean more competition, which means landlords can’t push rents up as they used to.

2. What’s Up with These High Operating Costs?

Operating costs are the silent killers of profit margins. Here’s a taste of what’s been happening:

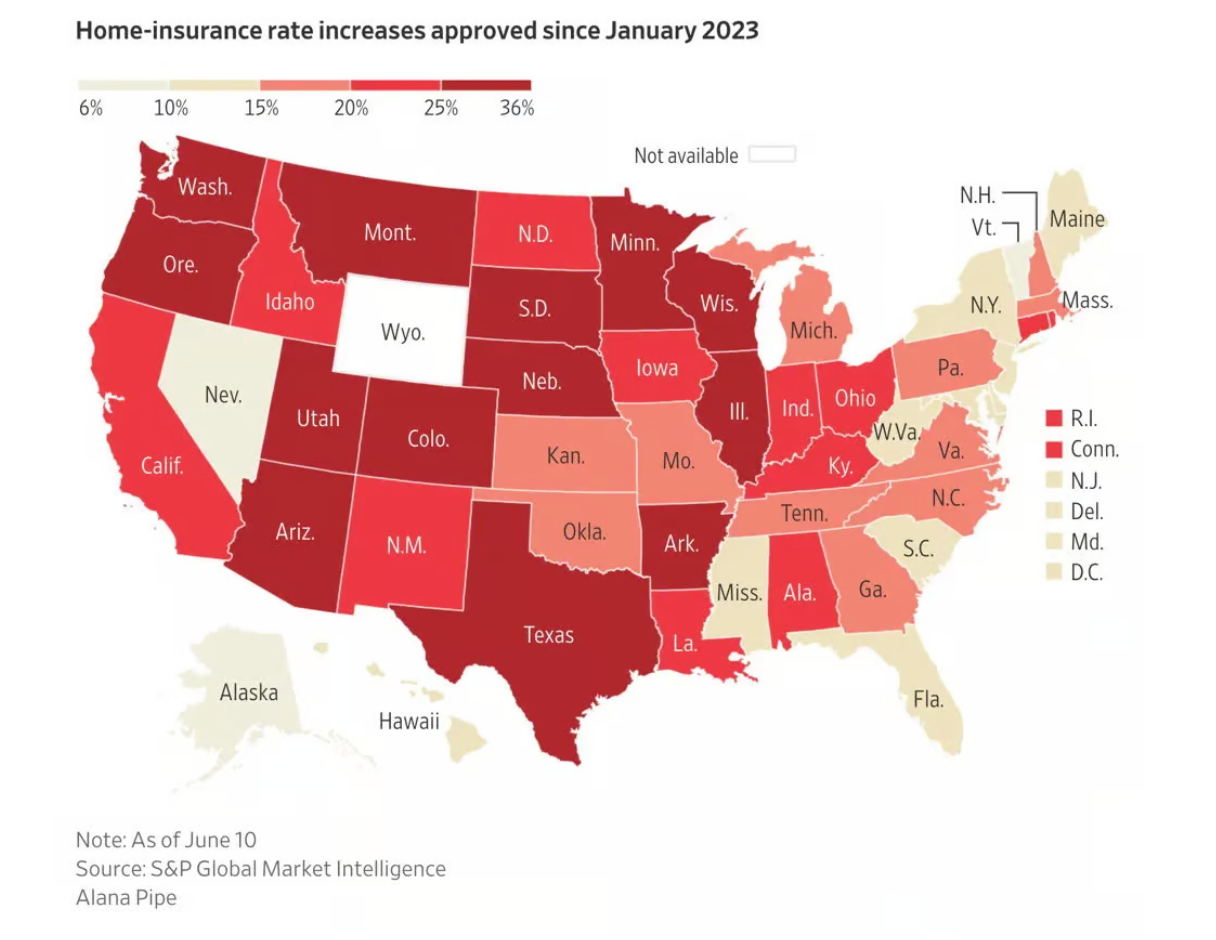

Insurance: Some markets have seen over 17% year-over-year increases. Ouch.

Payroll and Benefits: Up about $75 per unit for the lowest quartile, and near $120 for the highest.

Utilities and Repairs/Maintenance: Both have climbed significantly, adding around $55-$95 per unit, depending on your property’s revenue quartile.

So, if you’re feeling the pinch, you’re not alone. The costs are climbing, and it’s affecting everyone.

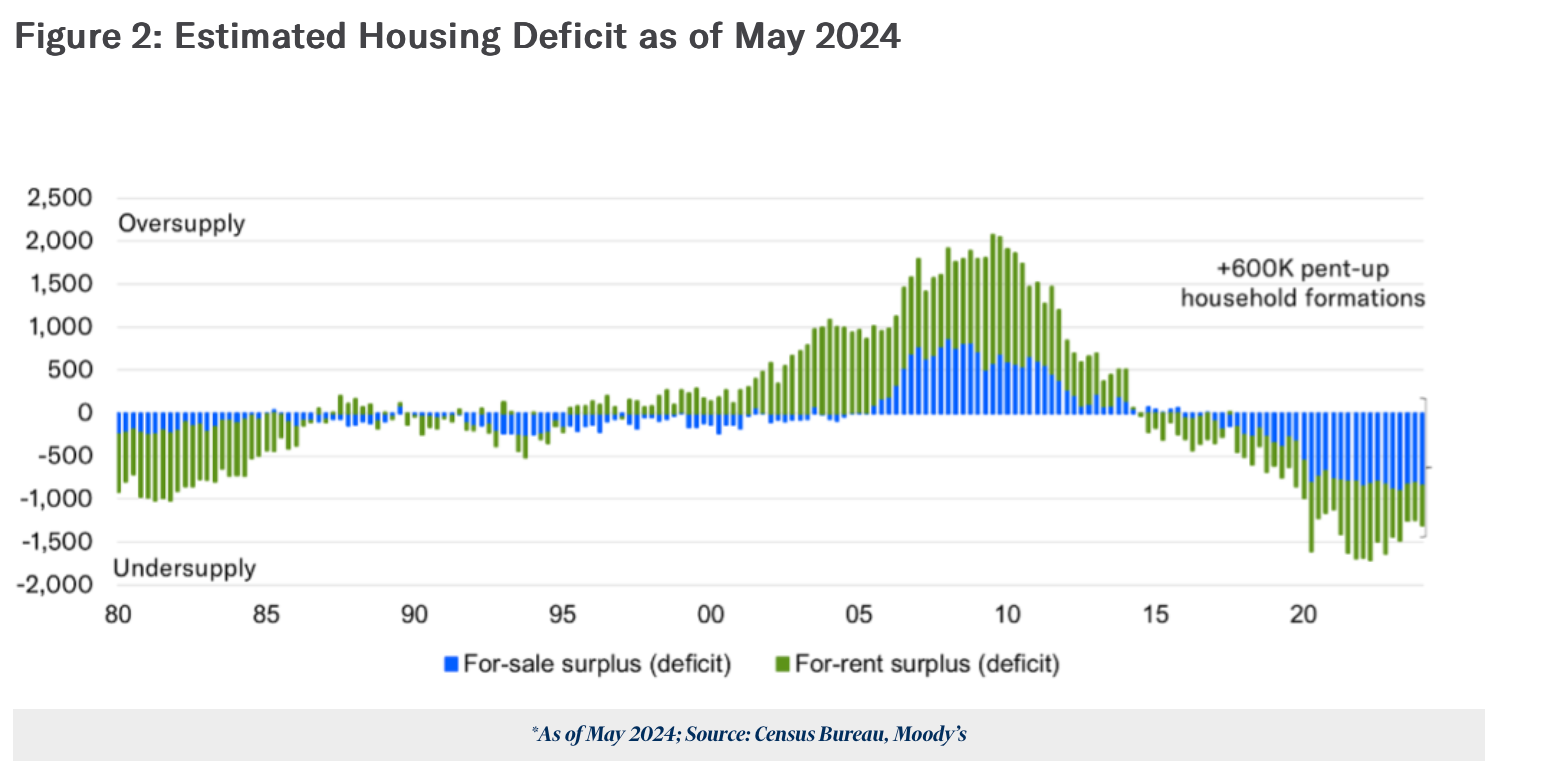

3. How Does Over-Supply Affect My Investment?

Over-supply is like that extra slice of pizza you didn’t need but ate anyway — now you’re stuffed, and it’s not comfortable.

The multifamily market is dealing with a similar issue. Construction has chased demographic trends, especially in the South and West, leading to unevenly concentrated supply increases.

Why does this matter? Because when there’s too much supply, rents stagnate or even drop. And when rents aren’t growing, your profits aren’t either. It’s a delicate dance of timing and location, and right now, the stage is crowded.

4. Why Is There a Gap Between Asking and Effective Rents?

Ah, the mysterious gap. On average, there’s a $90 difference between what landlords are asking for and what they’re actually getting. This has been the trend for three quarters now, thanks to the highest concession levels in Moody’s tracking history.

Think of concessions as those little perks — like a month of free rent or waived fees — that landlords offer to attract tenants. They chip away at your effective rent, the actual amount you pocket after all incentives are accounted for. So, while the asking rent might look rosy, the reality is often a bit less so.

Here’s where the rubber meets the road. How do you keep your ship sailing smoothly amidst stormy seas?

Optimize Operations: Scrutinize every expense. Can you reduce utility costs with energy-efficient upgrades? Is there a more cost-effective insurance option?

Smart Renovations: Focus on value-add improvements that attract higher-paying tenants without breaking the bank.

Market Savvy: Stay informed about local market trends. Know where the over-supply is worst and avoid those areas.

Leverage Technology: Use property management software to streamline operations and reduce overhead.

Negotiate Wisely: Whether it’s with contractors, insurance providers, or tenants, sharp negotiation skills can save you a bundle.

The market might be challenging, but with the right strategies and a keen eye, you can navigate it successfully.

Want more Real Estate reports, strategies and tips ?

Subscribe to the newsletter 👉 https://www.getgoldenground.com/ 🏡

Connect:

Twitter/X: https://x.com/VladShostak100